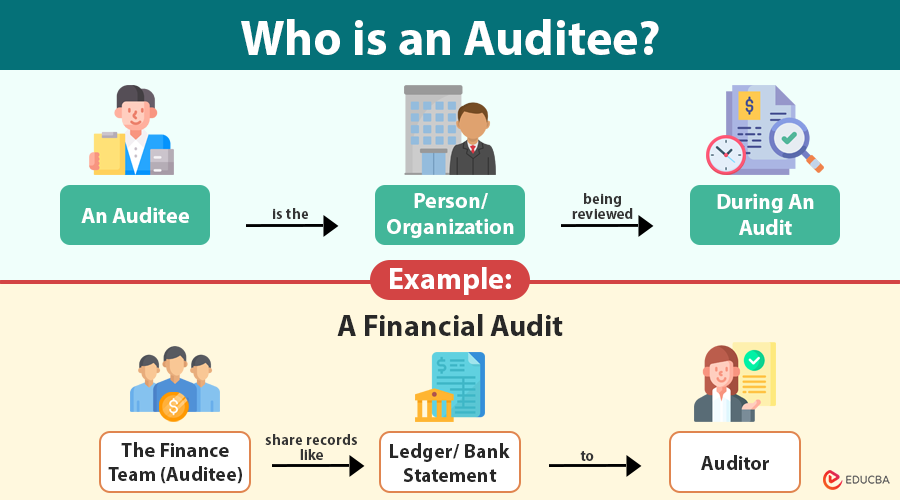

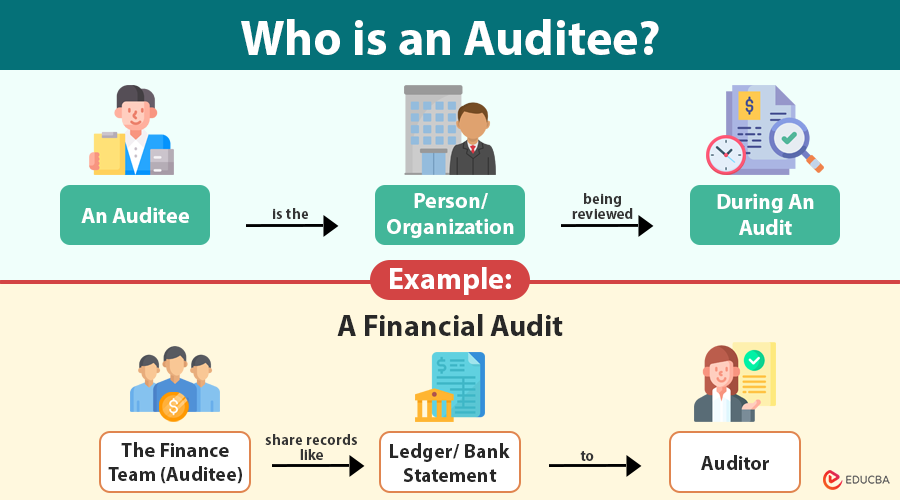

Who is an Auditee?

An auditee is any individual, organization, division, or department whose activities, systems, or financials are under scrutiny during an audit. The auditor evaluates the auditee as the subject of the audit. While auditors assess compliance and effectiveness, it is the auditee’s role to facilitate this process by providing access to relevant data and demonstrating adherence to applicable standards or regulations.

For example, during a financial audit, the finance team of a company acts as the auditee, providing documents such as ledgers, bank statements, and tax records.

They can exist at multiple levels:

- Individual (e.g., a department head or project manager)

- Team or department (e.g., HR, IT, or procurement)

- Entire organization (e.g., a company under external audit)

- Subsidiary entities (in multi-national corporations or holding companies).

Table of Contents

Types of Auditees

Different types of audits involve different auditees. Understanding this classification enables organizations to prepare effectively for each type of audit.

1. Internal Audit Auditee

- Includes internal departments such as HR, finance, IT, procurement, or operations.

- Goal: Ensure adherence to internal controls, process efficiency, and risk mitigation.

2. External Audit Auditee

- Involves the organization or its financial functions.

- Goal: Independent verification of financial statements for stakeholders and regulators.

3. Compliance Audit Auditee

- Focuses on departments responsible for regulatory compliance.

- Requires documentation like licenses, permits, and compliance reports.

4. IT or Information Systems Audit Auditee

- Includes system owners, IT teams, and network administrators.

- Requires demonstration of access controls, cybersecurity measures, and system logs.

5. Operational or Performance Audit Auditee

- Departments handling core business operations.

- Must show process efficiency, cost-effectiveness, and use of resources.

Roles and Responsibilities of an Auditee

Auditees are vital contributors to the audit’s success. Their key roles include:

1. Providing Accurate and Complete Information

- Submit financial records, contracts, SOPs, system reports, and employee logs as needed.

- Ensure data is traceable and corresponds to organizational policies.

2. Ensuring Transparent Communication

- Maintain open lines with the auditor.

- Address questions, clarify doubts, and avoid concealment of information.

3. Facilitating Access and Resources

- Grant system access, coordinate staff availability, and provide workspace for auditors.

4. Understanding the Scope and Criteria

- Know what the auditor is evaluating, which standards apply, and what evidence is needed.

5. Responding to Findings and Taking Corrective Action

- Review the audit report.

- Prioritize corrective actions.

- Track implementation and prepare for follow-up audits if needed.

Importance of the Auditee in the Audit Process

A cooperative and well-prepared auditee contributes to:

- Audit accuracy: Precise data leads to meaningful audit results.

- Process improvements: Helps identify inefficiencies and streamline operations.

- Transparency and accountability: Builds trust with stakeholders.

- Risk mitigation: Prevents future compliance or operational failures.

- Organizational growth: Strengthens internal controls and scalability.

Common Challenges Faced by Auditees

The following are some issues:

- Unfamiliarity with audit processes

- Incomplete or disorganized documentation

- Fear of being blamed for non-conformities

- Time constraints during audits

- Lack of communication with auditors.

Organizations must invest in training, clear documentation practices, and audit-readiness programs to overcome these.

Auditee Preparation Checklist

This practical checklist helps them get ready for audits:

| Task | Details |

| Understand audit scope | Clarify purpose, criteria, and expected deliverables |

| Review previous audits | Learn from past reports and address prior recommendations |

| Compile documentation | Prepare logs, financials, contracts, policies, and access records |

| Assign coordinator | Appoint a liaison between the audit team and the auditee departments |

| Brief your team | Educate staff on audit objectives, protocols, and expectations |

| Verify system access | Ensure systems, tools, and facilities are accessible to auditors |

| Schedule a pre-audit meeting | Align with auditors on timeline, deliverables, and priorities |

Case Study

Background

In 2022, a mid-sized logistics company failed its internal audit due to inconsistent documentation, weak IT access controls, and a lack of cooperation during interviews.

Intervention

The company:

- Created an internal audit response team.

- Appointed departmental coordinators.

- Conducted mock audits.

- Implemented a documentation standardization tool.

Results

In the following year’s audit:

- All departments passed without major findings.

- The auditor praised their transparency and readiness.

- The company saved ₹1.2 crore in potential penalties and insurance hikes.

Lesson: A proactive auditee can turn audits from a challenge into a strategic advantage.

Psychological and Cultural Aspects of Being an Auditee

Many auditees view audits with suspicion or anxiety. To overcome this:

- Encourage psychological safety: Create a workplace where employees feel comfortable speaking up about mistakes or concerns.

- Promote a learning culture: Treat audits as a way to learn and improve, not as a form of punishment.

- Avoid the blame game: Instead of naming and shaming, focus on fixing systems and supporting staff.

- Train for empathy: Train auditors to respect the auditee’s workload and context, encouraging mutual trust.

Impact of Technology on the Auditee Role

As audits go digital, auditees must adapt:

Use Audit Management Software

Tools like AuditBoard or SAP GRC streamline document collection, version tracking, and audit trails.

Prepare for Remote Audits

Virtual audits require:

- Digital file sharing tools

- Secure video conferencing platforms

- Online walkthroughs and access provisioning.

Cybersecurity Readiness

In IT and compliance audits, auditees must actively:

- Demonstrate encryption, firewalls, access control, and data backup mechanisms

- Produce audit logs and monitoring reports

Auditee vs Auditor: Key Differences

| Aspect | Auditor | Auditee |

| Primary Role | Independent examiner | Subject of examination |

| Objective | Evaluate compliance, performance, or financial integrity | Provide access and support during audit |

| Perspective | Outsider or internal evaluator | Insider familiar with systems and processes |

| Responsibility | Report findings, recommend improvements | Implement suggestions, correct non-conformities |

| Accountability | Accountable to stakeholders, regulators, or management | Accountable for compliance and corrective action |

The Auditee in Different Sectors

Auditees play vital roles across industries:

- Finance: Auditors assess branches or portfolios to ensure regulatory compliance and financial reporting accuracy.

- Healthcare: Auditors review hospitals for compliance with patient privacy (HIPAA), billing accuracy, and the integrity of medical records.

- Manufacturing: Quality control departments assessed for ISO standards and lean operations.

- Education: Schools or universities undergoing accreditation or funding audits.

- Public sector: Auditors examine how government offices allocate funds, manage procurement, and measure performance metrics.

Final Thoughts

The role of the auditee is fundamental to the auditing ecosystem. Far from being passive participants, auditees actively shape audit outcomes by providing accurate information, ensuring transparency, and committing to continuous improvement. Whether you are a team leader, manager, or department head, understanding and embracing your role as an auditee not only facilitates smoother audits but also strengthens your organization’s integrity, efficiency, and reputation.

Frequently Asked Questions (FAQs)

Q1. What should I do if I cannot find a document requested by the auditor?

Answer: Be honest. Inform the auditor immediately, explain the reason, and offer alternatives if available.

Q2. Can an auditee challenge audit findings?

Answer: Yes. You can provide justifications or counter-evidence. Most audits have a review or appeal process in place.

Q3. What if the audit scope is unclear?

Answer: Ask for clarification during the audit planning phase. It is essential to align expectations early.

Q4. How can small teams handle audit stress?

Answer: Start early, automate where possible, assign a single coordinator, and communicate workload constraints to the auditor.

Recommended Articles

We hope this comprehensive guide to auditees has helped you understand their vital role in the audit process. Explore these recommended articles to learn more about auditing types, compliance strategies, and internal control best practices.

- ERP Systems for Inventory Audits

- Food Safety Audit

- Continuous Compliance Learning

- Accounting Controls